The Town Deal

SPENDING REVIEW

Used a question during the Spending Review today to welcome new measures like the £4 billion Levelling Up Fund for local infrastructure but also underline to the Chancellor how Ipswich must be very much part of the mix when it comes to this funding, alongside the Midlands and the North. These regions are often spoken about when it comes to levelling up the country but our town deserves to be a big part of this conversation as well.

I also welcomed the increase in the schools budget by £7.1 billion by 2022-23 compared to 2019-20 and the plans to rebuild 500 schools over the next decade are important but we have to be clear that children with SEND must get the benefits of this funding as well. And it was good that in response to me the Chancellor was able to confirm that £300 million has been allocated for new school places for children with SEND which is about 4 times as much than was provided to local authorities a year ago.

More high quality special school places is something I’ve been calling for since my election, and I’ve seen first-hand how these places make a huge difference to youngsters through my involvement as a Governor at the new Sir Bobby Robson school in Ipswich. A further special school on Woodbridge Road in Ipswich is due to open in 2022 for young people with speech and language difficulties which is highly positive. But that being said, I know there are still children in Ipswich who would benefit from a place at a special school but can’t get one and we must go further. And I’ll be looking very closely at how Ipswich can benefit from this increased funding for new places the Chancellor spoke about.

It is the case that special school places to cost more, but it’s the right thing to do and we’ll all benefit as a society if children with SEND are able to achieve their full potential.

Helping the self-employed

Good news announced by the Chancellor at today’s press conference. I know this has been on the minds and a cause of anxiety for many of my constituents who are self-employed. I appreciate that sadly the various packages of support announced by Government don’t cover everyone but I am confident that today’s news will be a great source of help for many. Clearly at some point soon these support schemes will need to be phased out as we all get back to work but I think extending the scheme today was a sensible decision

Conversation with Chancellor of the Exchequer, Rishi Sunak

I was glad to be able to join the Chancellor of the Exchequer Rishi Sunak. I raised a number of issues, support for pubs, the self-employed and sole directors of limited companies. However a key local issue I raised was in relation to many of the different businesses in Town who haven’t quite been eligible for a number of different schemes. Many of the floating restaurants and cruising companies who work out of the waterfront have so far been badly impacted and none of the various schemes have supported them.

Today the Chancellor made clear that the local authority discretionary grants fund has the flexibility to cover these businesses, there had been some uncertainty on this point. I’m very glad about this, they are very important to our local economy, heritage and tourist sector. More detail to follow but positive signs

£750 million fund to support the charitable sector

Following yesterday’s announcement by Government that there will be a £750 million fund to support the charitable sector today I wrote to every single charity in Ipswich encouraging them to get in contact with me if there is anything they think I might be able to do to support them. Yesterday’s announcement was welcome but crucial questions remain and its vital that this money gets to the charities who need it the most ASAP. There are a huge number of charities carrying out invaluable work often with highly vulnerable people across Town and as a result of the coronavirus many face an uncertain future due to the way in which their fundraising activity has been negatively impacted. As I said yesterday I’m glad that half of the £750 million is being reserved for small local charities that work with vulnerable people.

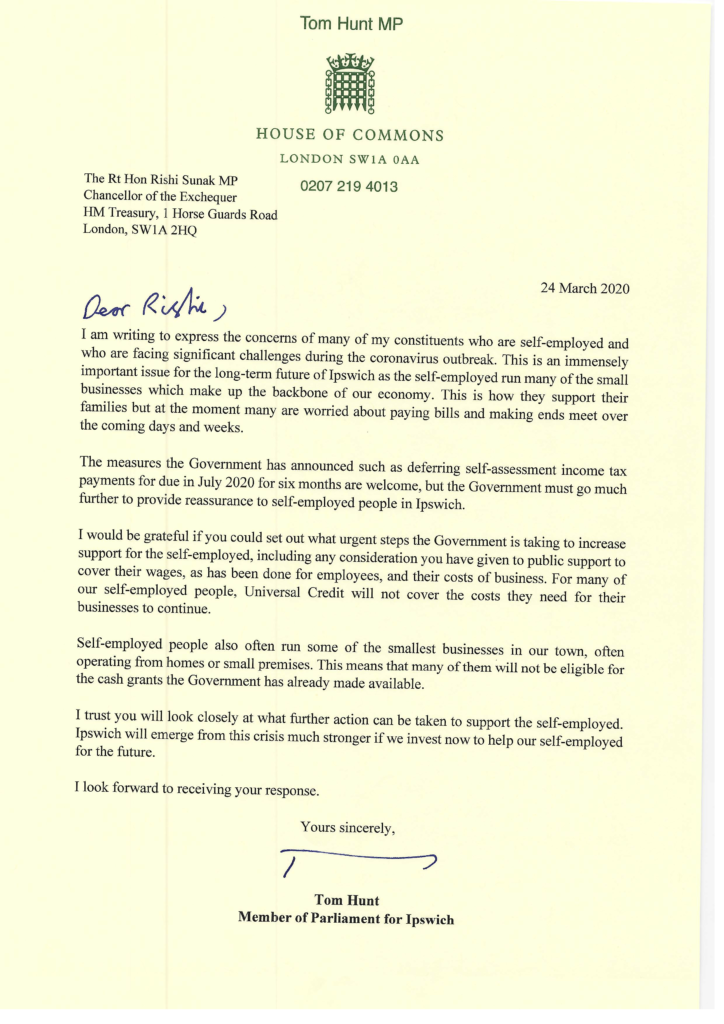

More support is needed for the self-employed

A significant number of you have written in to outline your concerns about the lack of support provided for the self-employed and freelancers. So far the economic measures announced by the Government haven’t really touched these groups and this is something I am very aware of. The Government has dramatically improved access to the benefits system for the self-employed, but clearly a lot more needs to be done. I understand that Treasury Ministers are currently working on a package of support for the self-employed and this support should be announced within the coming days. As the Member of Parliament for Ipswich I have written to the Chancellor of the Exchequer making clear my views and that more support for the self-employed should be forthcoming.

I am well aware of the huge contribution that the self-employed make to Ipswich’s economy and I will do whatever I can to support you during this difficult time.

STATEMENT ON TODAY’S ECONOMIC ANNOUNCEMENT

The coronavirus is not just a health emergency but an economic one too. And this evening the Chancellor set out unprecedented Government intervention to match the exceptional health measures set out by the Prime Minister yesterday.

Many constituents have been in touch with me over recent hours and days to tell me of the concerns they have for their livelihoods in this difficult time. It’s absolutely vital that households and businesses are economically secure so we can all focus on our health and that of our loved ones.

When we emerge from this coronavirus outbreak as we undoubtedly will, we will need our local businesses and their hard-working employees to be at the heart of our recovery. This includes our local pubs, shops, restaurants and leisure businesses who are so much more than just the backbone of our local economy. They are focal points for our community and contribute enormously to the social cohesion of our town. If we are unable to support them with our custom, we must support them and their employees in whatever way they need in the meantime. The Chancellor has responded to this in his statement this evening as he announced the following measures:

A package of government-backed and guaranteed loans to support business worth £330 billion initially. This will be available to businesses to pay their suppliers, rent and salaries. The £330 billion will be expanded with no ceiling if necessary.

For small and medium sized businesses, this money will be made available through an extension of the business interruption loan scheme announced in the Budget. This scheme will make loans available of up to £5 million per business with no interest due for the first 6 months. This scheme will be up and running by the start of next week.

Pubs, clubs, retailers and hospitality and leisure industry venues with an insurance policy which covers pandemics will be able to make an insurance claim.

For those types of businesses without insurance and a rateable value of less than £51,000, they will be entitled to an additional cash grant worth £25,000.

All pubs, clubs, shops and hospitality and leisure industry businesses will be exempt from paying business rates over the next year.

The 700,000 smallest businesses in the country will now receive a cash grant of £10,000, up from £3,000 as previously announced in the Budget.

A 3-month mortgage holiday for home owners affected by coronavirus.

The eligibility criteria for statutory sick pay will be extended so more are covered. Businesses will be supported with the extra costs incurred.

And for those who are ineligible for statutory sick pay, access to the benefits system will be sped up. Those eligible for universal credit will be able to access advanced payments without visiting a job centre. Support will be available from the first day of self-isolation or sickness.

Whenever statements like this are made which will have such a significant impact on people’s livelihoods, there is a focus on the detail which sometimes takes more time to come out. Many small business owners have already contacted me about how they can access the cash grants which will now be worth £10,000 and I’m urgently looking to obtain further information about this. I am fully aware that time is of the essence for their businesses and I’ll be working directly with pubs, shops and other local companies over the coming weeks and months. I will be available to meet with landlords, local business owners and store managers to go in to detail about the specific challenges they are facing. If you would like to arrange a meeting, please contact me at: tom.hunt.mp@parliament.uk

I understand the urgency of the situation and the importance of certainty for all businesses and households. I am closely following all developments and will be updating constituents as soon as I learn more. It’s welcome for example that clarification has already been given that pubs, cafes and restaurants will be able to offer takeaway and delivery services if they wish thanks to emergency changes in the planning laws.

The Chancellor was clear that today’s measures only represent one of several steps that will be taken as part of a comprehensive national effort to support our economy and I understand that a number of issues have yet to be fully addressed. This includes those private renters who have contacted me with their concerns about affording their rent if they become sick or have to self-isolate. The Chancellor has said he will make further statements soon about the issues faced by private renters and I’ll be following what this means for my constituents very closely.

The Chancellor emphasised today that he will do whatever it takes to support businesses and households through these exceptional circumstances. It’s now essential that this approach and the measures announced are realised on the ground in Ipswich. As the number of coronavirus cases reaches a point of rapid increase, we must get this right now. I will do whatever it takes as your MP to get businesses and households in our town the support they need.

Since my statement yesterday, I have also written to care homes and churches across Ipswich to offer my full personal support and the support of my office to many of the vulnerable people that they serve. I hope to be able to engage closely with these organisations to coordinate help for groups like the elderly. I’m setting up a service called ‘Talks with Tom’ to keep the vulnerable in self-isolation company over the phone and I’m also making myself available to help with things like shopping and dog walking. I’ll be working closely with charities and community groups like Age UK to ensure these initiatives are as effective as possible. If you would like to get involved, please do not hesitate to get in touch at tom.hunt.mp@parliament.uk

Please continue to follow the latest health advice through the NHS’s website: https://www.nhs.uk/conditions/coronavirus-covid-19/

And once again, please do not hesitate to get in touch if you have any coronavirus concerns. I can be reached at tom.hunt.mp@parliament.uk

I will keep you fully updated as the situation develops.

Tom Hunt welcomes Chancellor’s Budget as many campaign issues addressed

Today (11/03/20) Tom Hunt, MP for Ipswich, welcomed the Budget delivered by the Chancellor, Rishi Sunak, which addresses many of the issues Hunt had called to be addressed.

In a joint piece with Peter Aldous, Suffolk MP for Waveney, in the East Anglian Daily Times on Monday, Hunt had called for action on business rates and a reduction in beer duty to support local pubs. Both of these issues were addressed in the Budget, as the Chancellor announced a formal review of the business rates scheme this autumn. This is a priority for Hunt as he fights in Westminster for more support for Ipswich’s town centre and a level playing field high street retailers in the face of big online shops.

The Chancellor also announced a temporary suspension on rates for small retailers for the year 2020/21. Business rates will be abolished for leisure, retail and hospitality businesses with a rateable value of less than £51,000.

On beer duty, Hunt’s EADT article reinforced the case he’d previously made in a Westminster Hall debate on Beer and Pub taxation on 5 February 2020. In that debate, Hunt highlighted Suffolk’s proud pub heritage and the fact that 1,500 jobs are tied to pubs in his constituency. He urged the Government to get “150%” behind pubs by cutting beer duty in the next Budget so landlords felt less like tax collectors and more like small business owners. The Chancellor responded in today’s budget with a freeze on every single alcohol duty for the coming year. He also recognised the vital economic and social roles pubs play in towns like Ipswich as he announced that the business rates discount for pubs will increase from £1,000 to £5,000. Hunt recognises this as a step in the right direction, however, he would still like more to be done.

Hunt was also one of 35 MPs who before the Budget had co-signed a letter to the Chancellor expressing serious concerns about any rise in fuel duty. Today, the letter was found to have been successful as Rishi Sunak announced that fuel duty will be frozen for the tenth year in a row. This is an important victory for the hard-working people, many of whom rely on private vehicles to get to get to work or to run their business.

Hunt also welcomed the creation of a £1 billion fund for the removal of “all unsafe combustible cladding” after his campaign to make public money available for the removal of the type of highly combustible cladding that was on St Francis Tower in Ipswich. He also acknowledges that leaseholders at St Francis Tower will be keen to see more detail about how this money will be spent before fully breathing a sigh of release. But it’s positive that the Chancellor referred to ‘all unsafe cladding’.

Before, public money was only available for the removal of aluminium composite material cladding, the type found on Grenfell Tower, and not the equally dangerous high pressure laminate cladding found on St Francis Tower.

As part of this campaign, Hunt had raised the exorbitant bills being faced by leaseholders in St Francis Tower for cladding removal in a Westminster Hall debate on 12 February 2020. He had concluded his speech by calling on the Government for fairness for his constituents in St Francis Tower.

The Chancellor’s announcement of a £27 billion fund for the Strategic Road Network was also welcomed by Hunt as details emerge that improvements to the A14 Copdock junction will be part of this. The fund also includes a £2.5 billion allocations to fill up existing potholes and stop new ones from forming too. Improving road services and pavement services around Ipswich has been a focus for Hunt since his election as he personally visits streets across Ipswich to report potholes to the County Council. By working closely with Suffolk County Council Leader, Cllr Matthew Hicks, progress has already been made, including with the resurfacing of the pavement at Denton Close.

While it’s pleasing that many of Hunt’s priorities for Ipswich have been reflected in the Budget, Hunt still intends to speak during the Budget’s continuation debate over the coming days. It is vital that the investment issues facing Ipswich and Suffolk are represented specifically, having not received fair funding across the board over the years. This includes money for schools and education, Suffolk Constabulary and infrastructure.

Following the Budget, Tom said:

“Of course, this Budget will be talked about in relation to coronavirus and I welcome the strong measures the Chancellor to support our economy through this difficult time. The announcement that Statutory Sick Pay will be paid from the first day of absence is a particularly important step to give people reassurance when in self-isolation.

“As well as robust action on coronavirus, there are many positive developments in this Budget and we’re beginning to see real progress on many of the campaigns we have been working hard on. I am pleased to see the Chancellor has heard our concerns about ensuring ordinary people are not overburdened by taxes. The complete suspension of business rates for small retailers this year, and his commitment to a wide review the business rate scheme later this year, are crucial steps as we continue to fight for a vibrant town centre in Ipswich.

“The freezes in all alcohol duties and fuel duty also underline our efforts to ensure tax burdens do not fall on too heavily hardworking people. Before the budget, I co-signed a joint letter urging the Chancellor not to increase fuel duty and I spoke in Parliament about the need for Ipswich’s pub sector to be shown more support. I’m pleased that these messages are cutting through.

“It’s also good news that £1billion will be made available for the replacement of all types of dangerous cladding. It was unfair that St Francis Tower residents had to face exorbitant fees for the removal of the highly combustible cladding on their building just because it wasn’t the same type as that found on St Francis Tower.

“I will continue to digest the detail of this Budget and I intend to set out what it means for Ipswich and Suffolk in the ongoing debates on it next week”.